On January 31, 2024, the US Centers for Medicare & Medicaid Services (CMS) released the Advance Notice of Methodological Changes for Calendar Year (CY) 2025 for Medicare Advantage (MA) Capitation Rates and Part C and D Payment Policies. CMS also released a press release and fact sheet. The advance notice is released on an annual basis and includes proposed updates to the capitation and risk adjustment methodologies used to calculate payments to MA plans, as well as other payment policies that impact Part D. The final CY 2025 rate announcement will be published no later than April 1, 2024.

The advance notice discusses several updates the Inflation Reduction Act of 2022 (IRA) made for 2025, including:

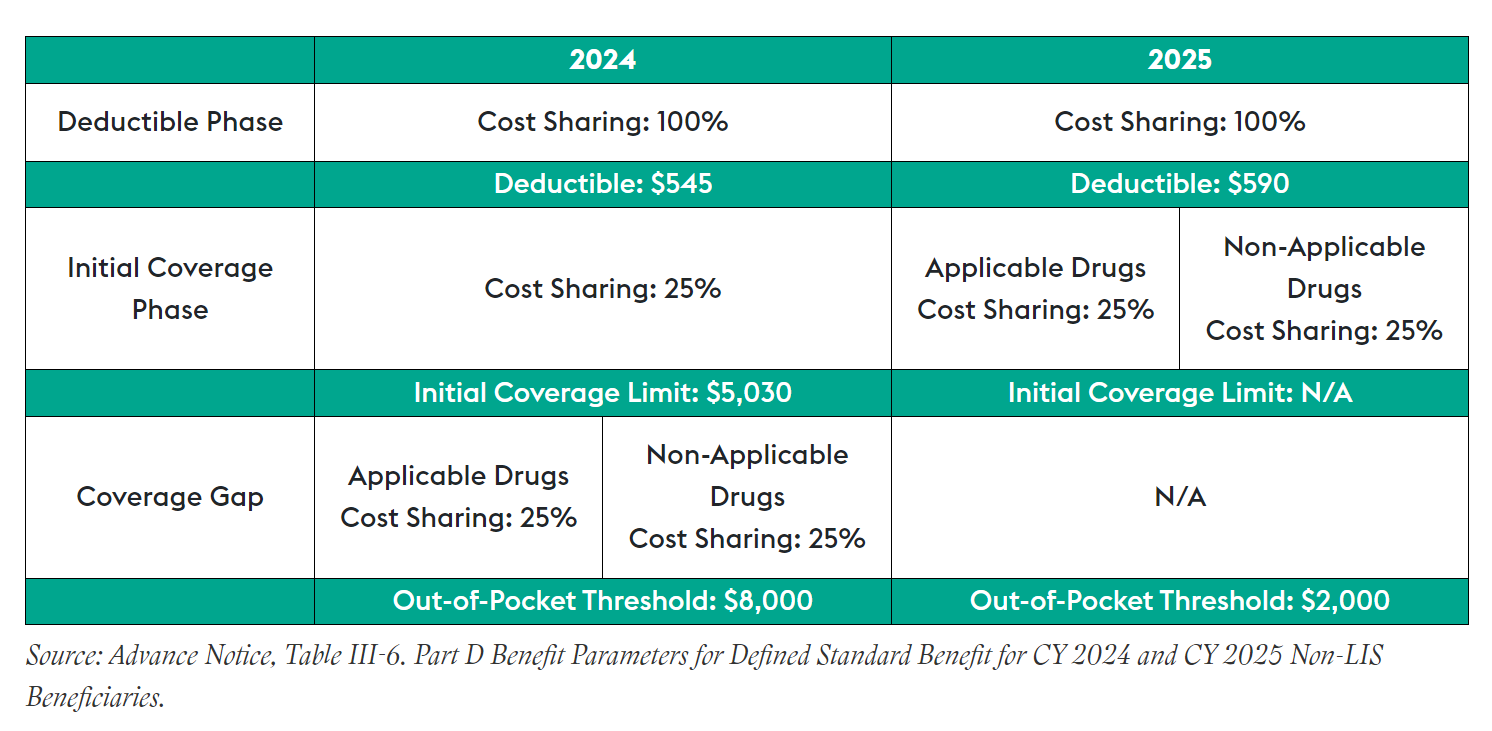

- Newly defined Part D benefit design composed of three phases: annual deductible, initial coverage and catastrophic coverage

- Lower out-of-pocket threshold of $2,000

- Sunset of the Coverage Gap Discount Program and establishment of the Manufacturer Discount Program, and

- Changes to the liability of enrollees, sponsors, manufacturers and CMS (Draft Part D Redesign Program Instructions, Draft Part D Redesign Program Instructions Fact Sheet)

As a result of the IRA, CMS proposes updates to the Part D risk adjustment model to reflect the Part D benefit design.

CMS is annually required to update the parameters for the defined standard Part D drug benefit. This is meant to ensure that the actuarial value of the drug benefit tracks changes in Part D expenses. For non-low-income subsidy beneficiaries, the advance notice outlines the benefit parameters for defined standard benefits in 2025 as follows: