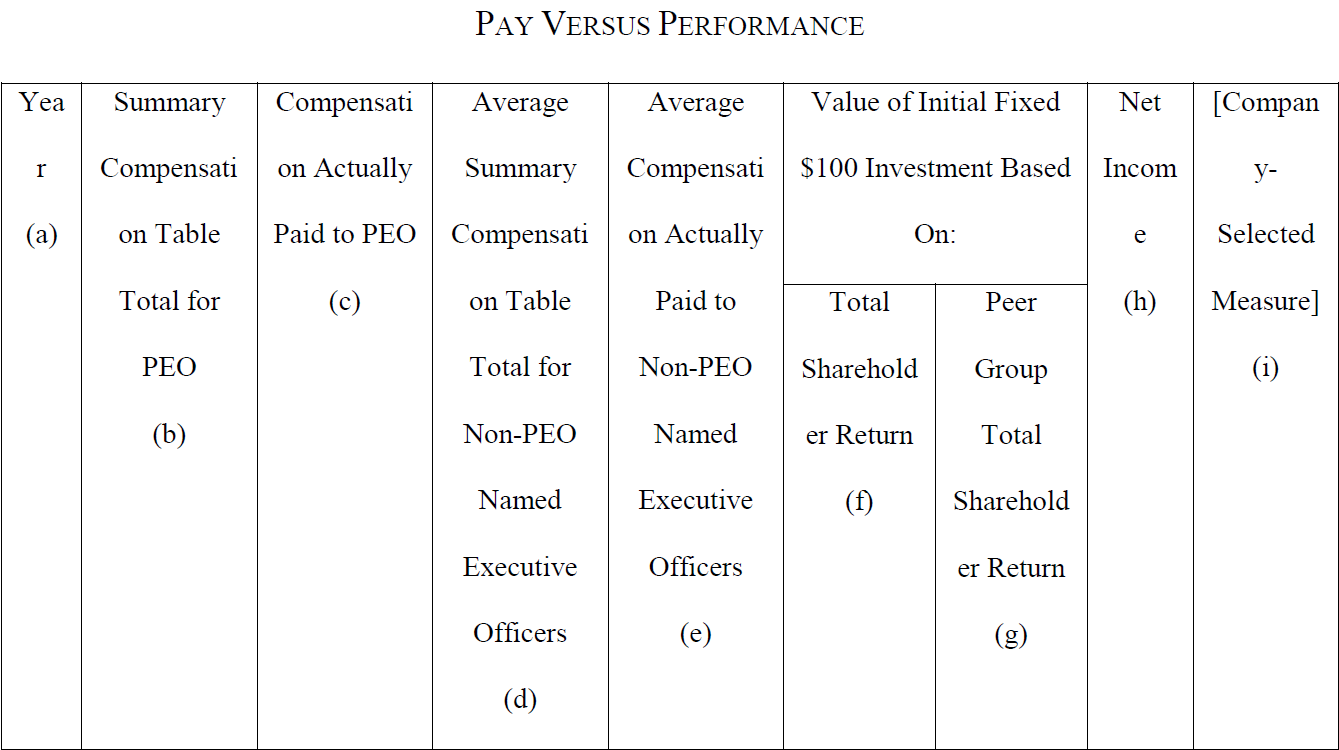

On August 25, 2022, the US Securities and Exchange Commission (SEC) adopted final rules to implement the pay versus performance disclosure requirement mandated by the Dodd-Frank Wall Street Reform and Consumer Protection Act (Dodd-Frank Act). The Dodd-Frank Act added Section 14(i) to the Securities Exchange Act of 1934, which directs the SEC to adopt rules that require registrants to clearly disclose the relationship between executive compensation actually paid and the registrant’s financial performance. More than 12 years after US Congress passed the Dodd-Frank Act, the SEC has adopted Item 402(v) of Regulation S-K to put these disclosure requirements into effect in time for the 2023 proxy season.

read more

Subscribe

Subscribe